This is now the fifth consecutive month of decline, although the monthly fall is the smallest recorded so far this year.2

Ongoing global supply chain issues, predominantly the lack of semiconductors, continued to frustrate order fulfilment. This was exacerbated by Covid lockdowns in key manufacturing, and logistics centres in China, plus disruption from the war in Ukraine, all of which restricted production output and thus supply into the UK new car market.

The SMMT data has revealed that there was an 18.2% fall in registrations by large fleets, to 50,014 units, while consumer registrations remained steady at 59,847 units.

As a result, private registrations in the year to date are now 3.7% up on 2021, as manufacturers around the world are prioritising private customers.

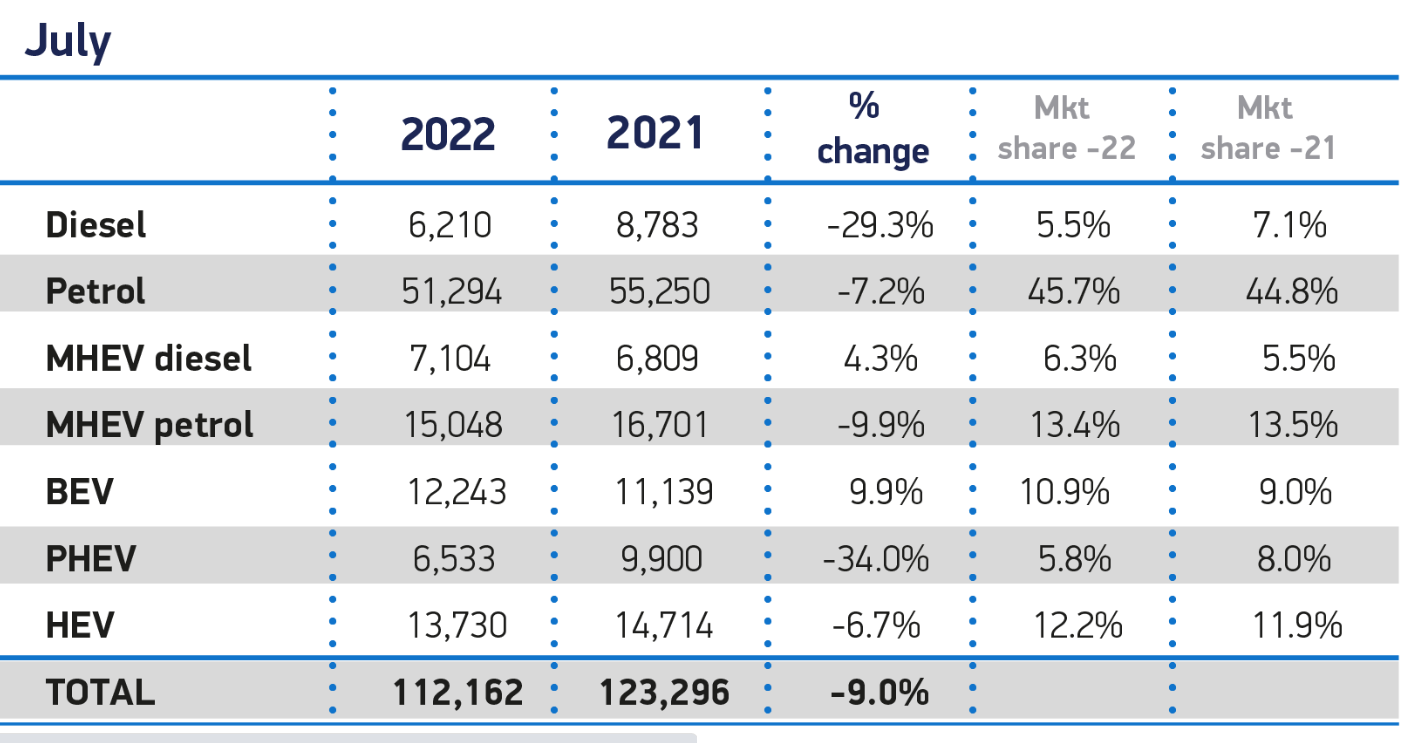

Marking a shift in buying habits this year, battery electric vehicle (BEV) uptake grew 9.9% to 12,243 units to achieve a 10.9% market share for the month. Although this is the weakest monthly uplift recorded by BEVs since the pandemic, overall growth in the year has reached 49.9% to deliver a 13.9% market share, illustrating the volatility in the supply chain.

July was a weaker month for hybrid electric vehicle (HEV) uptake, with registrations falling 6.7% to take 12.2% of the market. Plug-in hybrids (PHEVs) fell 34% which cut their market share to 5.8%.

Following the release of the SMMT data, RAC EV spokesperson Simon Williams said: “The global semiconductor shortage continues to affect the supply of new cars, though electric vehicle registrations continue to buck the trend of market decline with year-on-year growth.

“With high fuel prices and the overall cost of living continuing to bite, drivers are increasingly looking to low-running-cost alternatives to petrol and diesel vehicles. However, the upfront cost remains a barrier for private EV purchases, so we call on the Government to think about reinstating the plug-in car grant.”

So far this year, the industry has faced more challenges than initially anticipated, due to the enduring severity and impact of the semiconductor shortage and global conflicts.

While the sector expects the second half to improve as supply issues start to recede, it is unlikely that the market will be able to recover the significant losses sustained so far.

According to SMMT, the outlook for the full year has been revised downwards to 1.6 million new car registrations – a 2.8% fall on 2021, with the industry facing its most challenging year for three decades.

They also believe that the plug-in market share will continue to grow, however, to reach 22.6% as manufacturers prioritise investment in zero emission vehicle production.

Likewise, although the 2023 outlook has also been revised downwards since the April estimate, it is likely to be an improvement on 2022, with overall registrations anticipated to reach to 1.89 million (rather than 2.02mn), with plug-ins comprising 27.8% of the market.

Mike Hawes, SMMT Chief Executive, said: “The automotive sector has had another tough month and is drawing on its fundamental resilience during a third consecutive challenging year as the squeeze on supply bedevils deliveries. While order books are strong, we need a healthy market to ensure the sector delivers the carbon savings government ambitions demand.

“The next Prime Minister must create the conditions for economic growth, restore consumer confidence and support the transition to zero emission mobility.”

1 July’s figures reflect a short interruption to registrations processing at one manufacturer due to a planned systems upgrade affecting a limited number of vehicles. This does not materially affect the overall market performance.

2 June -24.3%; May -20.6%; April -15.8%; March -14.3%

RAC sale – up to 33% off*

• Roadside cover from £5.49 a month*

• We get to most breakdowns in 60 mins or less

• Our patrols fix 4/5 breakdowns on the spot