Are diesel vehicles about to face a tax hike?

We’re pretty sure that something big is coming, but we don’t know just how big it is, what it looks like, or when it will actually get here.

We’re pretty sure that something big is coming, but we don’t know just how big it is, what it looks like, or when it will actually get here.

That’s what we were all left thinking after Philip Hammond’s recent Spring Budget. It promised that the Government will consult with various stakeholders on the ‘appropriate tax treatment for diesel vehicles’, before potentially announcing some policy changes in this year’s Autumn Budget. Diesel is officially up for review.

Here at the RAC, we know that this is a subject that concerns our customers directly, so we thought we’d put together a primer on the whats, whys and wherefores of the diesel debate. Here’s your guide to one of the most important topics in motoring right now.

Background to the review #1: Air quality

Why is diesel receiving special attention from politicians? It all comes down to air quality. Recent studies have established a link between air quality, poor health and early deaths. Several years ago, policy makers encouraged the take-up of diesels because they emitted lower levels of CO2 compared to petrol vehicles. But then scientists and environmentalists began to focus on other air pollutants that are harmful to people, such as the mixture of nitrogen oxides (NOx) and Particulates (PM). It turns out that diesel engines are a major source of NOx and certain particulates.

This led to Britain’s Supreme Court, in a major ruling in April 2015, demanding that the Government do more to curb these air pollutants. The UK has been in breach of the European Union’s NO2 limits since they first came into force in 2010 – so action had to be taken. Recently, the High Court also ruled the Government’s measures in tackling air pollution needed to be strengthened.

Background to the review #2: Existing policies

This action has been relatively limited so far. Some observers thought that various car taxes would be reformed so that they penalised NO2 emissions instead of CO2 emissions, but that hasn’t happened yet. Most of the major car taxes are still designed to penalise CO2 emissions, although a ‘diesel surcharge’ was added on to the rates of Company Car Tax (CCT). This means that people driving diesel company cars have to pay an extra 3 percentage points on top of the standard rates of CCT. This measure was originally going to be phased out in April last year, but has been retained for the foreseeable future.

Outside of national government, various localities are legislating against diesel too. The most prominent of these is London. The previous London Mayor Boris Johnson announced that an Ultra-Low Emission Zone would be introduced in 2020. The current Mayor, Sadiq Khan announced that he intends to expand the zone and bring forward its introduction to 2019, which will see a fee imposed on the most polluting vehicles that travel through it. In the meantime, in October this year, he will also introduce a special T-charge – that is, toxicity charge – for older vehicles. Similar measures which are likely to focus on heavier goods vehicles are being likely to be drawn up in other cities, including Birmingham, Leeds and Southampton, as part of the effort to establish new Clean Air Zones.

Some local authorities are also looking at penalising diesel vehicles for parking, with Westminster evaluating their charges, and owners of vehicles in the borough of Islington subject to a diesel residents parking surcharge.

Background to the review #3: Prices

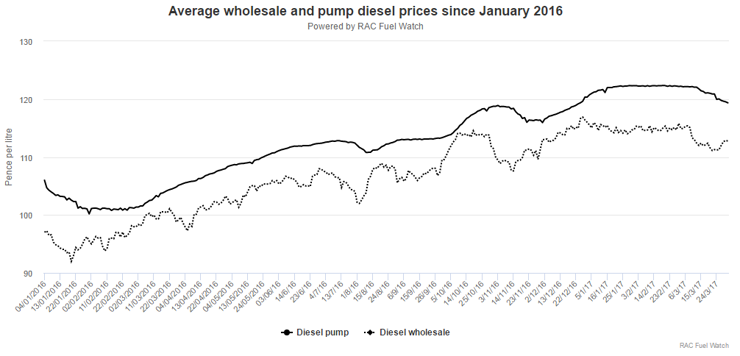

Policies, whether national or local, are only part of the story for anyone who owns or runs a diesel vehicle. In recent years, they’ve enjoyed much lower prices even though they rose in 2016 and the early part of 2017.

As our graph above shows, the cost of a litre of diesel is currently around the 121p mark (March 2017). This is rather less punishing than the peak of 148p in 2012, but it’s still about 20p higher than the seven-year low at the beginning of last year.

The reasons for this price rise are manifold. The primary reason for this is the increase in the cost of oil. In early 2016 oil fell to $26 a barrel paving the way for low petrol and diesel pump prices. More than a year later it was trading at around $50 a barrel. This combined with a far weaker pound and fuel being traded in dollars means prices are considerably higher. Diesel, too, is affected by other factors including the fact that the UK imports more than 40% of its diesel, mostly from Russia.

The increase in the cost of fuel has put a strain on both household finances and company budgets. To help businesses manage their fuel costs the RAC has introduced a special Fuel Card that offers advantages, including discounts on diesel, to commercial fleets. At a time of fluctuating fuel prices, it’s particularly important to manage your costs carefully.

Background to the review #4: Sales

Whether it’s the warnings of politicians or the cost of the fuel itself, diesel cars have become less popular over recent months. According to figures from the Society of Motor Manufacturers and Traders, 261,538 were registered in the final quarter of 2016, which is a 4% decline on the same period in 2015. In fact, their share of the overall marketplace has gone from 51% to 48% over the same time.

In the meantime, more people are turning to alternative fuels. In 2016 88,909 new electric and hybrid cars were registered– a 22% increase on the previous year.

What happens next?

It is against this backdrop that the Government is considering a review on the taxation of diesel vehicles. It’s likely that they will publish a set of initial proposals in the coming months, which will then be open to consultation, before any final decisions are taken in Philip Hammond’s Autumn Budget later this year.

Of course, we don’t know what form those proposals will take until they are published. There may be some changes to the VED system which targets more polluting vehicles, or perhaps the Government will look at fuel duty rate differentials between petrol and diesel vehicles. Or perhaps they will simply replicate what they’ve already done for Company Car Tax, and introduce higher rates for diesel.

Whatever the case, the main question is whether diesel drivers will be treated fairly. After all, it wasn’t long ago when politicians were encouraging people to buy diesel vehicles. Those people hardly deserve to be penalised for doing so.

What would be a fair outcome? The Government is reportedly considering a diesel scrappage scheme. This would see motorists compensated – in the form of cashback or money off a newer, cleaner car – for turning in their old vehicles. That would certainly make going green a little bit easier.

You can keep up to date with with the latest Fuel prices from RAC Fuel Watch.