Breakdown cover explained

What is car breakdown cover?

Breakdown cover is a type of insurance that means you get help if your vehicle breaks down. It can help you get back on the road if you have a flat battery, clutch or other engine problems.

If you break down and are unable to get your vehicle moving again, a mechanic or trained professional will be sent to help. If they can’t fix your car on the spot, they’ll tow you to a nearby garage.

We offer breakdown cover across a range of vehicles including cars, hybrid and electric vehicles, motorbikes and more.

What types of breakdown cover are there?

You can buy breakdown cover for cars, an alternative vehicle, or a person in any vehicle.

- Vehicle breakdown cover means your vehicle is covered no matter who is driving. You can cover up to 3 vehicles that are registered at the same address.

- Personal breakdown cover means you’re covered in eligible vehicles as a driver or passenger. You can cover up to 5 people from the same household on the same policy.

Which level of cover is best for me?

We offer 3 levels of cover: Basic, Extra and Complete. Roadside Assistance is available with all cover levels. And if you need more cover – for example, ‘National Recovery’ – you can choose Extra or Complete. You can also add optional extras, like ‘Onward Travel.’

Here are the main differences to help you find the right cover for you.

Basic

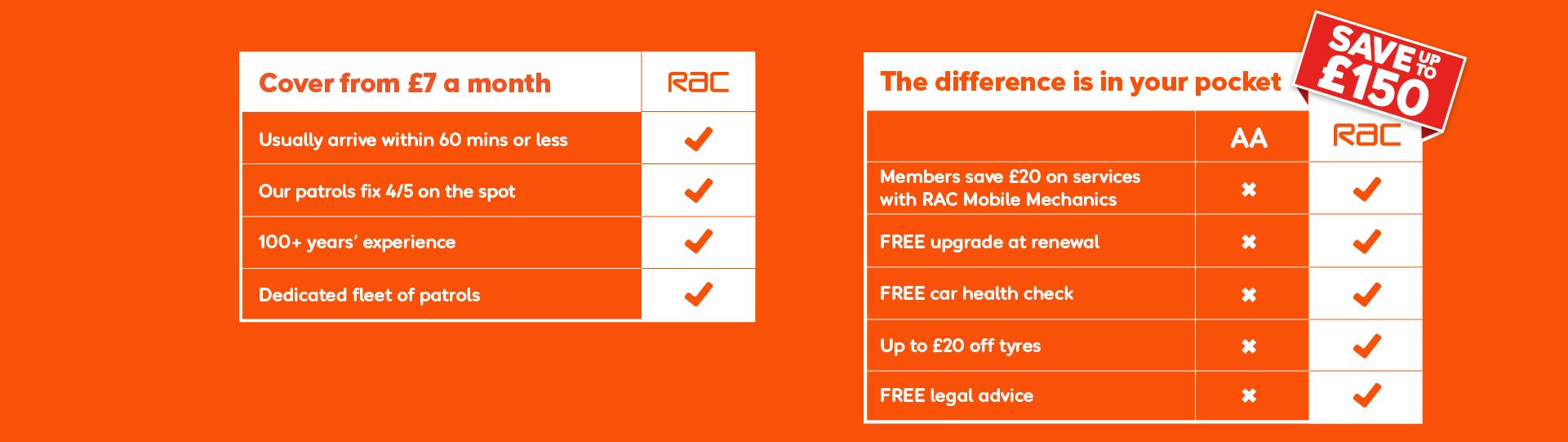

This is our cheapest breakdown cover option, at just £7 a month. And if we’re running an offer, you might find an even better price. It includes:

- Roadside Assistance

We’ll fix you on the spot, if you’re ¼ mile from home. Or if we can’t, you'll get breakdown recovery up to 10-miles to a garage or another destination. - 5 callouts

You can call us out up to 5 times a year, with 1 additional callout added for every person or vehicle added. If you need more than this, our Complete cover includes unlimited callouts.

Extra

In addition to Roadside Assistance and 5 callouts, our Extra cover also includes:

- National Recovery

Instead of a 10-mile tow, we'll tow you and your passengers to any garage or destination the UK.

Complete

This provides you with the most breakdown cover features. In addition to everything in Extra, our Complete cover also includes:

- Unlimited callouts

You can call us out as many times as you need, as long as it’s not for a recurring problem. - At Home

We’ll rescue you at home or within ¼ mile of your home. - FREE MOT

You'll also get a FREE MOT at selected RAC garages, worth up to £55. With Family Breakdown Cover you'll get 2 Free MOTS.

.png)