Our extra cover can protect you from an unexpected bill – from £1.25 a month*

*Price for Legal Care Plus.

We’ll always come to your rescue if you break down. But there are other unexpected costs that come with running a car. New tyres or a replacement battery can land you with a big bill.

With our range of extra cover, you can avoid these unexpected costs – from £1.25 a month. Please note that prices include all applicable taxes.

Key Replace – £3.50 a month

Replacing keys and fobs costs £300 on average.

But with Key Replace, your car and house keys are covered if they’re lost, stolen or accidentally broken. We’ll cover the cost of replacing them and your locks if needed. And we can arrange a hire car if you need one.

How it works

- Up to £1,500 of cover

- If you lose your car or house keys, or they’re accidentally broken or stolen, we’ll replace them and cover the cost

- With lost car keys, we’ll also re-programme the electrics so your locks, alarm and immobiliser still work

- To keep you going while we arrange the keys for your vehicle, we can arrange a hire car for up to 72 hours or we’ll pay up to £80 for alternative transport

- If we think there’s a security risk with lost or stolen house keys, we’ll replace your locks as well

What’s not covered?

- Business vehicles or vehicles covered under a motor trade insurance policy

- Keys that are broken because of wear and tear or ageing

- Any claim where the event took place before or during the first 7 days of your Key Replace cover

- Claims where there’s no evidence that you own the keys

- The cost of replacing locks if you already have a set of spare keys

- Replacing an insured key within the first 3 days of losing it (unless we agree separately)

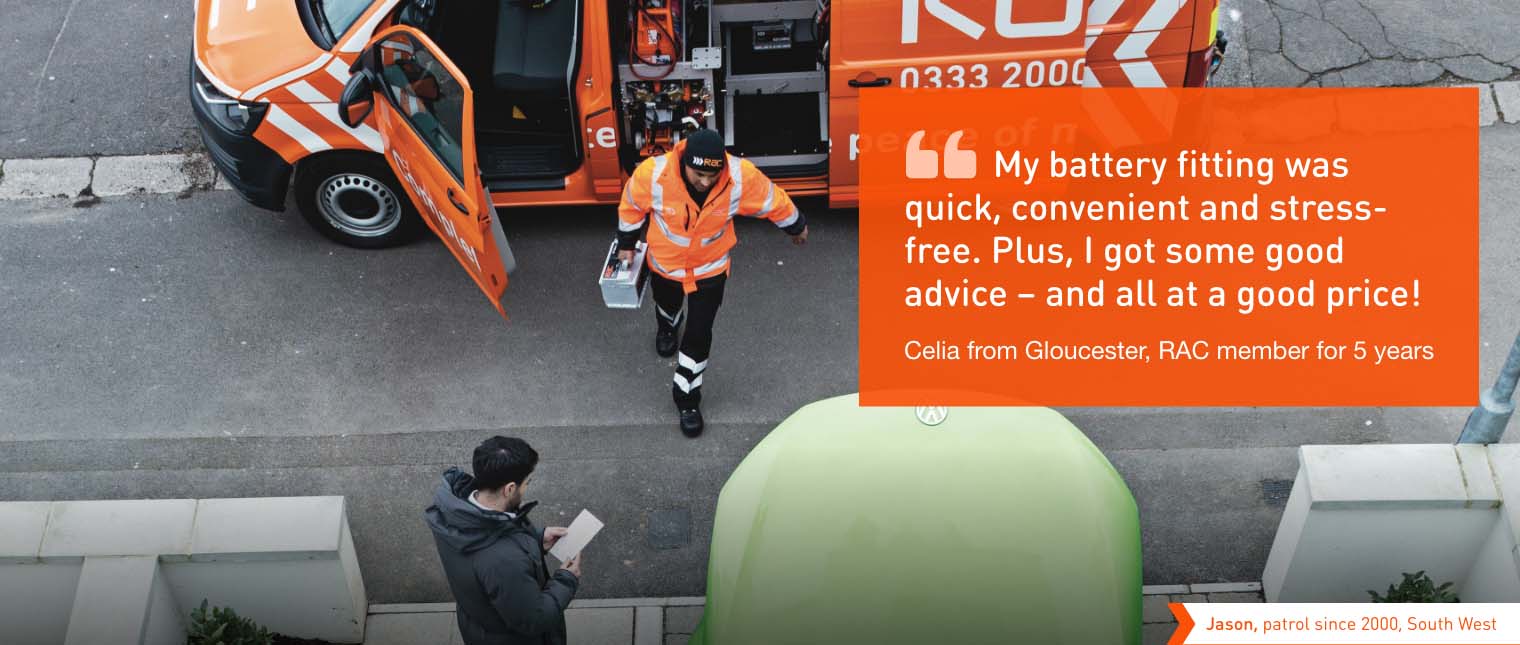

Battery Replace – £4 a month

Without cover, the average new battery costs £250.

But with Battery Replace, we’ll replace yours if you break down due to a battery problem and we can’t recharge it. So you won’t have to pay out for a new one.

How it works

- You’re covered up to £600 for a battery on your nominated vehicle

- If you break down because of a faulty starter battery, we’ll test it with our state-of-the-art tester

- We’ll help you find the right battery for your vehicle if you need a new one

- We’ll fit your new battery there and then

- We’ll recycle your old battery for you

What’s not covered?

- Batteries on a motorhome, kit car, quad bike, trike, caravan or trailer

- Any claim where the event took place before or during the first 7 days of your Battery Replace cover

- Batteries that need to be fitted by the manufacturer or garage

Tyre Replace – £7.00 a month

A set of new tyres could cost you £520.

But with Tyre Replace, we’ll repair or replace up to 5 tyres, up to £180 each, if yours are punctured or maliciously damaged and can’t be repaired.

How it works

- You’re covered for up to £180 a tyre for 5 tyres

- If we can, we’ll temporarily repair the tyre so you can drive to one of our tyre network garages for a replacement

- If it can’t be repaired, we’ll get your vehicle to one of our tyre network garages and cover the cost of a replacement tyre, a replacement valve and wheel balancing

- We’ll also dispose of the old tyre for you

What’s not covered?

- Wear & tear, misuse or tyres below the legal tread level

- Damage caused by incorrect maintenance of your vehicle. This could be damage caused by uneven wear on tyres because of poor tyre pressure, misaligned wheels, defective steering or suspension

- Any claim where the event took place before or during the first 7 days of your Tyre Replace cover

- Tyres on a motorhome, kit car, motorcycle, quad bike, trike, caravan or trailer

Legal Care Plus – £1.25 a month

With Legal Care Plus we’ll cover unexpected legal expenses related to your car.

For example, if you’re in an accident that wasn’t your fault, we’ll cover up to £100,000 in legal expenses to help you claim back your losses. Like your policy excess, replacement vehicle costs and loss of earnings. Covers up to 5 people.

How it works

- Uninsured loss recovery: up to £100,000 to help you recover costs that aren't covered by your standard car insurance after an accident that wasn't your fault. That can include:

- policy excess

- lost earnings

- damage to personal items

- medical or rehabilitation costs

- Legal defence: up to £100,000 in legal costs if you're summoned in connection with an alleged motoring offence involving your vehicle.

- Travel costs (Europe): up to £1,000 for travel expenses related to legal proceedings after an accident in Europe.

- Consumer disputes: up to £100,000 to help with legal expenses if you need to make a claim after buying, selling, repairing or servicing a vehicle.

- 24/7 Advice: we’ll also offer advice on personal legal matters in the UK. This isn’t just limited to motoring – you can get legal advice on wills, probate, employment, family, buying and selling property, and many other personal issues

Eligibility & exclusions:

- Your case must have more than a 51% chance of success to qualify for support.

- You're not covered for incidents that happened before you bought this policy.

- Please check whether you already have similar legal cover through your existing car insurance or another provider.

European Rescue – £108 a year

With European Rescue, you can relax and enjoy your trip. We’ll get you going again if you break down on the continent – or even if your car fails you just before your trip.

Call 0330 159 0925 to add European Rescue

Please note: adding European Rescue isn’t available online

How it works

- We’ll help you at the roadside if you break down in Europe

- If we can’t get you fixed there and then, we’ll get you a hire car or overnight accommodation for the rest of your trip

- Hire car up to £125 a day (overall limit £1,500)

- Accommodation up to £50 a person a day (overall limit £500)

- If we can’t repair your car abroad we’ll make sure you, your family and your vehicle get back to the UK safely at the end of your visit

- We’ll cover the cost of sourcing and delivering any spare parts needed for the repair, as well as garage labour costs up to £150

- If you break down in the UK up to 48 hours before you’ve planned to go to Europe, you’re covered for a hire car for up to 6 days to continue your journey

- We’ll cover a caravan or trailer if you’re towing one

- We’ll cover up to 9 people, in 49 countries across Europe

What’s not covered?

- More than 1 claim in the UK and 1 claim in Europe for each trip, or more than 3 claims in a policy period

- Garage labour allowance for repairs completed after the day of the breakdown

- Bringing your car back to the UK if the cost of transporting or repairing it would be more than the current price of the car

- Journeys longer than 90 days

- Journeys that don’t start and end in the UK

- Trips made before you purchased the cover, or where you purchased the cover outside of the UK

Key Replace – £3.50 a month

Replacing keys and fobs costs £300 on average.

But with Key Replace, your car and house keys are covered if they’re lost, stolen or accidentally broken. We’ll cover the cost of replacing them and your locks if needed. And we can arrange a hire car if you need one.

How it works

- Up to £1,500 of cover

- If you lose your car or house keys, or they’re accidentally broken or stolen, we’ll replace them and cover the cost

- With lost car keys, we’ll also re-programme the electrics so your locks, alarm and immobiliser still work

- To keep you going while we arrange the keys for your vehicle, we can arrange a hire car for up to 72 hours or we’ll pay up to £80 for alternative transport

- If we think there’s a security risk with lost or stolen house keys, we’ll replace your locks as well

What’s not covered?

- Business vehicles or vehicles covered under a motor trade insurance policy

- Keys that are broken because of wear and tear or ageing

- Any claim where the event took place before or during the first 7 days of your Key Replace cover

- Claims where there’s no evidence that you own the keys

- The cost of replacing locks if you already have a set of spare keys

- Replacing an insured key within the first 3 days of losing it (unless we agree separately)

Or call 0330 159 0925

Our full terms and conditions apply.

Standard, Advanced or Ultimate breakdown cover terms and conditions

UK breakdown cover terms and conditions