What is family travel insurance?

Family travel insurance covers two adults living together and their children – usually up to 18 years old – who live with them. With this single plan, you don’t need separate policies for each family member. It protects you from travel cancellations, medical emergencies, lost luggage, and delays. Many plans include cover for multiple children at no extra cost.

Before you buy a policy, check the details. Some plans don’t cover children who travel alone, with non-family members, or who don’t live with you full-time.

We’ve partnered with Hood to offer protection for the whole family when you travel. We know that the cost of travelling with kids can add up, so we want to give you great value and the cover you need.

Emergency medical expenses and 24/7 helpline

Lost and delayed luggage

Cancellation cover

Cover levels

You can select from three levels of family travel insurance cover available with varying benefits, so you can find the right cover to suit your needs, letting you relax and enjoy your holidays throughout the year.

Orange cover

Up to £3,000 cancellation cover

£10m emergency medical & repatriation expenses

£1,250 for personal possessions

£500 hospital benefit (max £20 per day)

£500 gadget cover

£400 personal money

£25,000 legal costs & expenses

Silver cover

Up to £5,000 cancellation cover

£15m emergency medical & repatriation expenses

£2,000 for personal possessions

£1,500 hospital benefit (max £50 per day)

£500 gadget cover

£500 personal money

£25,000 legal costs & expenses

Black cover

Up to £7,500 cancellation cover

Unlimited emergency medical & repatriation expenses

£3,000 for personal possessions

£2,000 hospital benefit (max £50 per day)

£500 gadget cover

£750 personal money

£25,000 legal costs & expenses

What's not covered?

Here are some of the things that aren't covered:

- Medical conditions unless Hood have approved them in writing.

- You must have the proper passport, visa, and travel permission to be covered.

- Cancellations for reasons that aren’t listed in your policy.

- The loss or theft of money if you do not report it to the police within 24 hours (or as soon as possible) and provide a written report.

What are the benefits of family travel insurance?

Family travel insurance covers the whole family with one easy policy. It keeps everything in one place, which is helpful when travelling with kids. The policy covers things like buggies, car seats, and lost luggage. It also provides 24/7 emergency help, so you can always get assistance when you need it.

How much is family travel insurance?

The cost of family travel insurance depends on a few key factors. Here are four things that can affect your policy price:

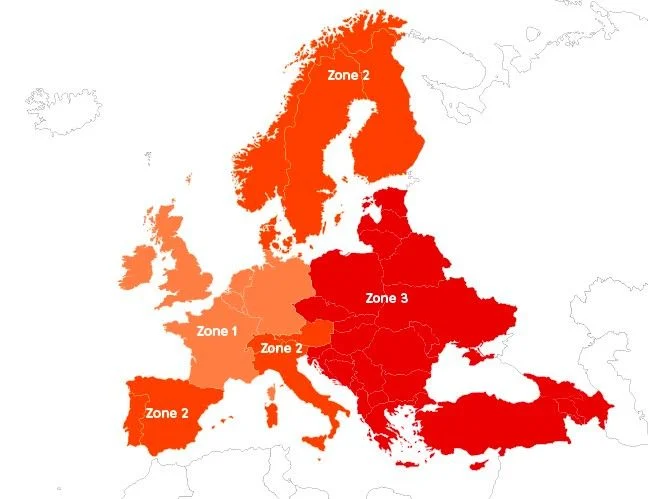

- Destination – travelling to places with high healthcare costs or risks, like natural disasters, can raise the price.

- Trip duration – longer trips usually cost more.

- Policy type – if you take multiple trips in a year, an annual policy might be cheaper than buying one for each trip.

- Pre-existing medical conditions – if anyone has a pre-existing medical condition, the cost may go up.

Boost your cover with optional extras

Enhanced gadget cover

With enhanced gadget cover, get additional cover against accidental damage, theft or loss of your gadget or devices

Winter sports cover

With winter sports cover, get extra cover for ski equipment, piste closures, accommodation issues and more

Cruise cover

You’ll be covered for medical cabin confinement, missed ports, unused excursions and more

Travel guides

Still not sure? Find answers to your questions

You need to buy your family travel insurance before you begin your trip. If you purchase it after your trip has started, it won’t be valid. To ensure you’re covered for any mishaps, the best time to get the insurance is as soon as you book your trip. This way, you are protected for any claims before you leave.

Yes, family travel insurance usually covers adults traveling alone. However, children tend to need to travel with an adult listed on the policy to be covered.

All RAC Travel policies allow you to travel alone if you’re 18 years of age and over

Yes, every family member must have a GHIC. A GHIC (Global Health Insurance Card) gives access to free state health care in the EU and Switzerland.

Yes, cover is suitable for separated and divorced parents.

Even if you're staying in the UK, getting travel insurance for your holiday can be a smart choice. It can help cover costs related to cancellations, delays, and lost or delayed luggage.